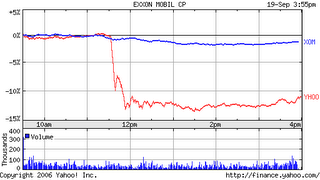

YHOO Free Fall

Yikes. Yahoo took a pretty big hit today, after warning that 3rd quarter revenues are going to be on the low end, thanks to a....slowdown in the demand for online advertising.

Yikes. Yahoo took a pretty big hit today, after warning that 3rd quarter revenues are going to be on the low end, thanks to a....slowdown in the demand for online advertising.Seems like not that long ago that everyone was talking about the online ad shortage. Now we see warnings from one of the big 3 that there's a surplus? How did that happen?

Well, I haven't listened to the conference call or anything, so I can't talk specifically about Yahoo, but there are for sure some trends that have risen, as of late.

The first is that there is a tremendous blooming of inventory. YouTube's getting in the game, as are the blog networks and the game developers and my neighor's uncles' barber. Plus, the inventory is getting more interesting, with video stuff, sponsorship packages and better targeting. More stuff means shortage no more, premium pricing no more.

The other thing is that it seems that advertising can sometimes be a very lagging indicator of the economy as a whole. When this week's media plans were being put together, gas was north of $3.00 and the inflation specter was looming. That affects the decision to advertise, especially for anything extravagant. The online ad market has this built in nimbleness, and--if the marketing department felt that something should be cut, it wasn't going to be broadcast or outdoor. Online is easy to pull back on.

The third thing is, not to get too worried. Online advertising's bread and butter is still direct marketing. If you have to have a bad quarter, the third isn't such a bad one to choose, simply because you know the 4th will be great: the holiday buying season will bring all the regular ad buyers out, and Yahoo will see a bounce.

0 Comments:

Post a Comment

<< Home